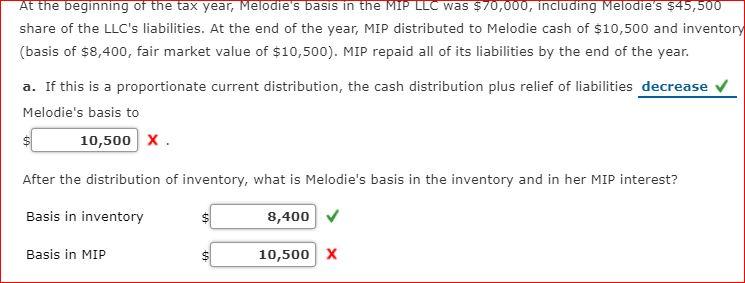

Required information Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in - Brainly.com

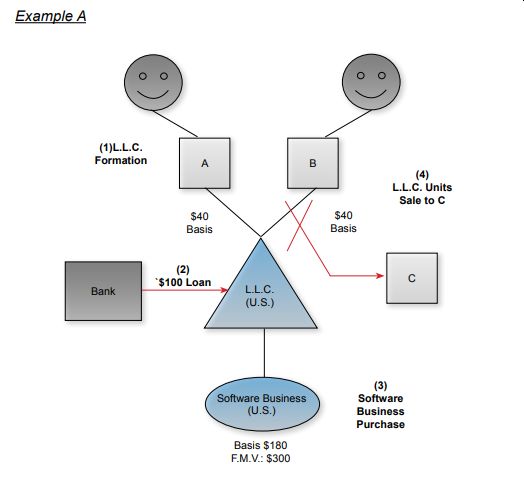

Tax 101: Tricky Issues When A Non-U.S. Person Invests In An L.L.C. Or Partnership Operating In The U.S. - Withholding Tax - United States